TripCare 360 Travel Takaful

A protection plan that travels with you

Whether you're travelling for a business trip, going for a family holiday, or setting out on a new adventure, TripCare 360 Takaful is here to make sure a small setback doesn’t turn into a big worry. This shariah-compliant plan ensures your protection stays in line with your values.

Eligibility

Available for Malaysians and non-Malaysians departing from Malaysia

Adult

16–70 years old

Senior Citizen

71-80 years old

Child

45 days - 18 years old

(or up to 23 years old if unmarried, unemployed or a full-time student)

Why sign up with Etiqa?

Cashback rewards for annual plan

Get rewarded from surplus sharing if no claims are made when your annual plan expires.

Find Out MoreCashless overseas hospitalisation

Receive medical treatment without paying upfront at most hospitals

Call NowBaggage and trip protection

Claim reimbursement for lost or delayed baggage (6 hours and above), damaged items, cancellations or missed connections.

Find Out More24/7 Overseas Emergency Travel Assistance

Receive assistance overseas at any time, including hospitalization, evacuation, repatriation, and more.

Call NowAutomatic delay payout

Receive automatic payout for flights delayed for 2 hours or more

Try Our Travel Delay Calculator NowOne contribution covers the entire immediate family

Covers 2 adults and up to 10 children for a single contribution.

Apply NowEnjoy extra peace of mind to cover you

We've got add-on benefits for adventurous activities, golf equipment cover, Covid-19 and extended home care benefit.

Find Out MoreWhat’s covered?

Learn more about our travel takaful coverage below. From personal belongings to flights and medical emergencies, our support is available whenever you need it.

Transport coverage during your trip

Covers flight, trains, cars, ships, and other licensed transport modes.

*Coverage applies to any scheduled or licensed mode of transport during your tripAccidents & Disability

Compensation for accidental death or permanent disability.

Medical Care

Cashless hospital admission overseas, reimbursement for outpatient treatment and follow-up care after you return home.

Personal Liability

Protection against accidental injury to others or damage to their property.

Travel Disruptions Takaful

Reimbursement for trip cancellations, delays, or missed connections.

Personal Belongings

Compensation for lost, damaged or stolen luggage, travel documents, or personal money.

Emergency Services

Evacuation, repatriation, compassionate visits, and funeral arrangements if needed.

What’s not covered?

While TripCare 360 Takaful covers a wide range of travel delays, medical emergencies and losses, there are some limits. For example:

Sports, or activities such as sky diving unless you’ve added the Adventurous Activities Coverage.

Pre-existing medical conditions and any related complications

Self-inflicted injuries, attempted suicide, or mental health disorders.

Pregnancy-related complications, sexually transmitted diseases, HIV, or issues related to alcohol or drugs.

Air travel other than as a fare-paying passenger on a regular scheduled or licensed chartered flight.

Delays shorter than 2 hours.

No payout if the delay was announced 12 hours earlier by the airline.

No payout for trip cancellations if you sign up your travel plan less than 7 days before your departure date.

Countries not covered for International Trip:

Malaysia, Afghanistan, Antarctica, Belarus, Cuba, Libya, Iran, Iraq, Israel, Myanmar, Nepal, North Korea, Palestine, Russia, Syria, Sudan, South Sudan, Ukraine, Venezuela

Travel to countries or regions affected by war, conflict, quarantine for contagious disease, or those under international sanctions.

Participation in illegal acts, such as provoked assault.

Actions by government authorities that result in loss or delay.

Travel for Hajj pilgrimage

Hazardous jobs

Additional add-ons

Add extra protection tailored to your travel plans, activities, and personal needs.

COVID-19 Travel Takaful

If COVID-19 affects your trip, you are covered for:

- Trip cancellations or disruptions due to COVID-19 up to RM5,000

- *Overseas medical treatment (up to RM 300,000)

- *Emergency evacuation or repatriation (up to RM 100,000)

- *Burial, cremation, or return of remains (up to RM 100,000)

Choose the right plan for your needs

Find a plan that fits your lifestyle — whether you’re protecting yourself, your loved ones, or a group.

Myself

16-70 years old

Senior citizen

71-80 years old

Spouse and I

18-70 years old

Family

Spouse and children only

Group

16-70 years old.

Add up to 21 adults

When should I sign up my travel takaful?

You should sign up for your travel takaful anytime before your trip begins — even on the day you travel.

Before your trip starts

You must sign up for your travel takaful before you leave Malaysia, at least 2 hours before departure. However, we recommend that you do so 6 hours prior your flight.

Recommended time

Sign up at least 7 days before your trip to enjoy cancellation coverage.

If you want to sign up in advance

You may sign up your travel takaful half year in advance

Choose a plan that fits how you travel

Not every traveller is the same, and neither is every trip. Choose flexible coverage that fits how and where you travel.

Covers one continuous journey from departure to return, perfect for short holidays, business trips, or family vacations.

Coverage | Domestic | International | ||

|---|---|---|---|---|

| Silver | Gold | Platinum | ||

| Accidental death or permanent disability | ||||

| Per adult/senior citizen | RM50,000 | RM100,000 | RM300,000 | RM500,000 |

| Per child | RM10,000 | RM40,000 | RM100,000 | RM100,000 |

| Maximum per family* | RM150,000 | RM300,000 | RM900,000 | RM1,500,000 |

| Medical Expenses Medical expenses in excess of RM100 | Due to accident only | Due to accident or illness | ||

| Individual | RM50,000 | RM100,000 | RM300,000 | RM500,000 |

| Maximum per family* | RM125,000 | RM250,000 | RM750,000 | RM1,500,000 |

| Trip cancellation / curtailment | ||||

| Per person | Not covered | Not covered | RM20,000 | RM50,000 |

| Maximum per family* | Not covered | Not covered | RM50,000 | RM125,000 |

| Travel delay | ||||

| First complete 2 hours | RM100 | RM100 | RM100 | RM100 |

| Every 6 hours thereafter | - | RM250 (up to RM1,000) | RM250 (up to RM2,000) | RM250 (up to RM5,000) |

| Maximum per family* | RM250 | RM2,500 | RM5,000 | RM12,500 |

| Baggage delay (min. 6 hours) | ||||

| Per person | RM500 | RM500 | RM800 | RM1,000 |

| Maximum per family* | RM1,250 | RM1,250 | RM2,000 | RM2,500 |

| Missed travel connection | ||||

| Per person | Not covered | RM400 | RM500 | RM600 |

| Maximum per family* | Not covered | RM1,000 | RM1,250 | RM1,500 |

Baggage & personal effects | ||||

| Per person | RM1,000 | RM1,000 | RM3,000 | RM5,000 |

| Maximum per family* | RM2,500 | RM2,500 | RM7,500 | RM12,500 |

Maximum Per Family* refers to a maximum limit payable for families under the 'Family Plan'.

- Coverage starts when you leave your home to begin your journey and ends at the earliest of the following:

- When you arrive back home

- Expiry date of your certificate

- Coverage starts 6 hours before your scheduled departure and ends at the earliest of the following:

- When you arrive back home

- 6 hours after you return to Malaysia

- Expiry date of your certificate

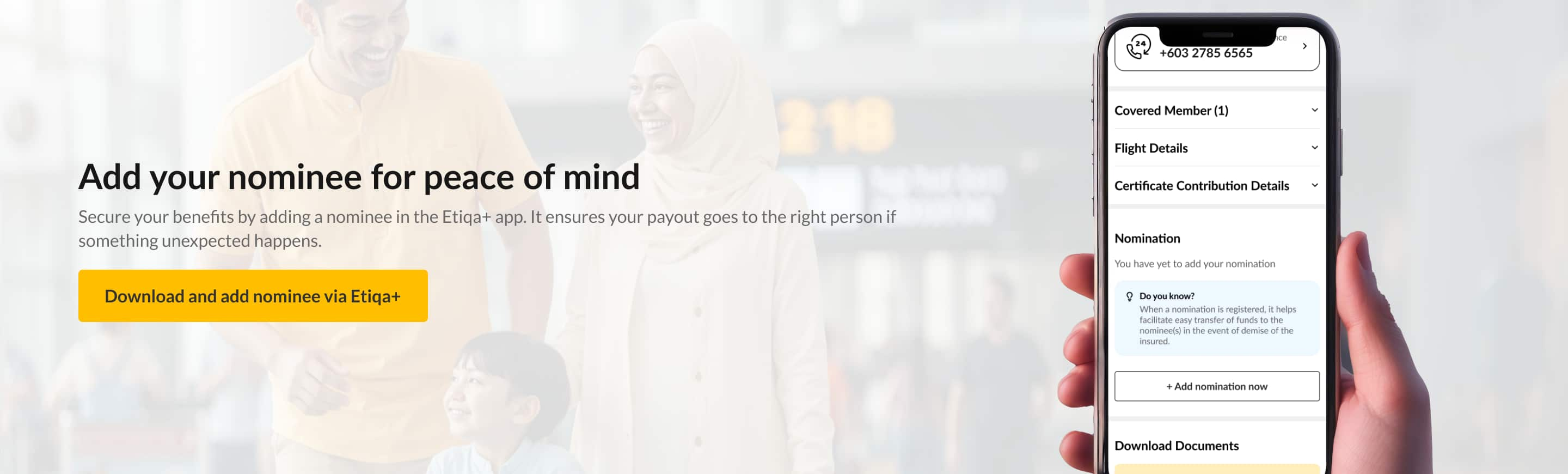

Add Your Nominee for Peace of Mind

Secure your benefits by adding a nominee in the Etiqa app. It ensures your payout goes to the right person if something unexpected happens.

Download and add nominee via Etiqa+When the unexpected happens

We are here to guide you when things happen unexpectedly.

What if I get sick before my trip?

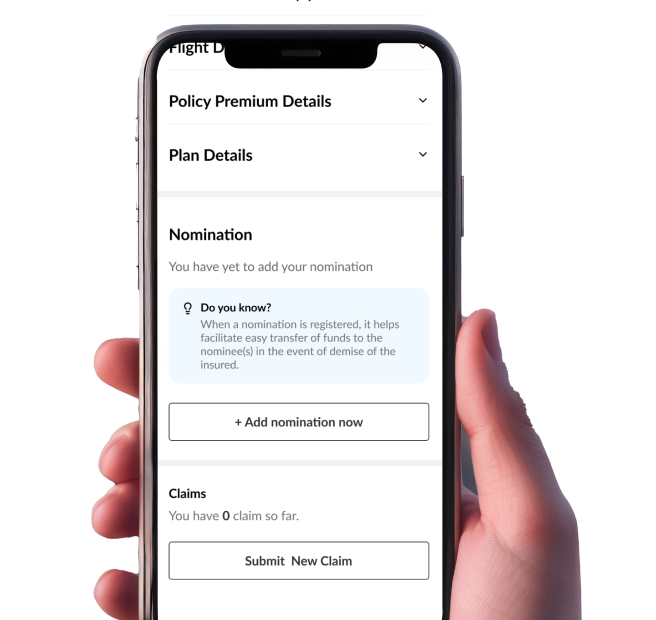

Unable to travel due to illness? You may be eligible for a cancellation claim. Upload your medical proof and booking details into the Etiqa+ app.

What if I’m admitted to the hospital during my trip?

If you need to be hospitalised while travelling, your medical and hospital expenses may be entitled to cashless medical care. Just call our 24/7 Travel Assistance Helpline, Claims Careline or get help via the Etiqa+ app.

Pre- existing illnesses are not covered.

What if my personal belongings are stolen?

If your items are stolen during your trip, you may be able to claim for the loss. Report the incident to the local police within 24 hours and keep the police report, receipts, and any supporting documents for your claim via the Etiqa+ app.

We’re here whenever you need us

If you need help while travelling, we’re here 24/7, anytime, anywhere you are.

Overseas Emergency Travel Assistance:

+603 2785 6565Claims Careline (office hours only):

1 300 88 1007Download the Etiqa+ app

Download nowMake a claim in just a few taps

Step 2

Select “Make a Claim” under TripCare 360 Takaful.

Step 3

Upload your documents, receipts, reports, or proof of loss.

Step 4

Submit and track your claim in real time.

You can find more details about our travel claims here.

FAQs about TripCare 360 Takaful